Another Way of Looking at a Country’s Carbon Footprint: A Tale of Switzerland and South Africa

How should sovereign debt investors think about ‘Paris Alignment’? Shikeb Farooqui, Joe Leadbetter, and I dig into the details and show that some of the leading proposals lead to perverse consequences that are not aligned with the goals set out in the Paris Agreement. We suggest a sensible alternative.

Download the report here.

About The Report

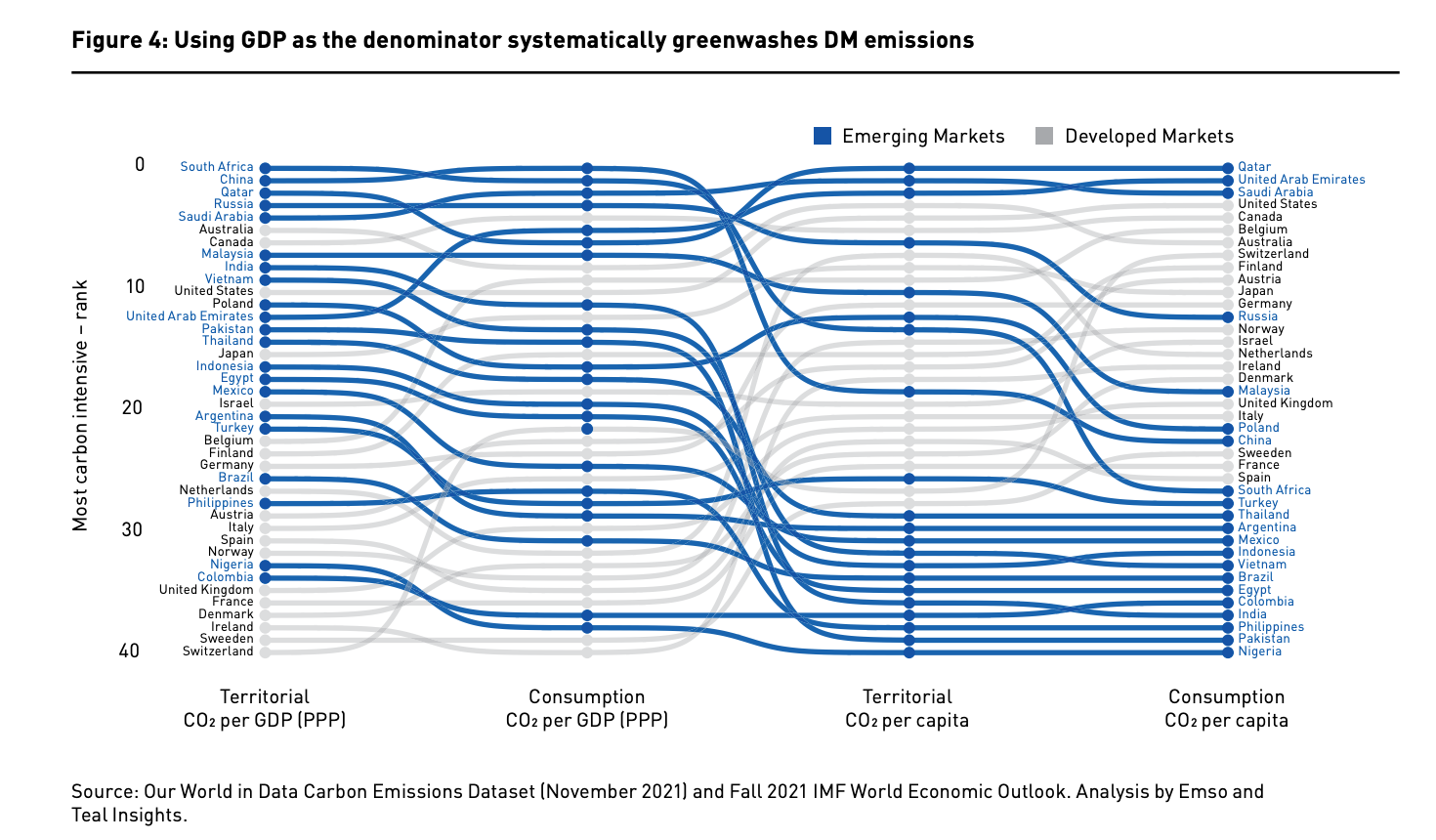

In the wake of the COP26 Conference, climate pledges are at the forefront of investors’ minds, and while enthusiasm for the initiative is high, we think that this enthusiasm for climate pledges merits caution and careful analysis. In the white paper, Emso’s Joe Leadbetter and Shikeb Farooqui, along with Teal Emery, analyze how investors have historically approached sovereign carbon footprint evaluations, how emerging markets have fared compared to their developed market counterparts, and finally, how investors might challenge the historical process for assessing sovereign carbon footprints.

Citation Information

Citation

BibTeX citation:

@report{leadbetter2022,

author = {Leadbetter, Joe and Farooqui, Shikeb and Emery, Teal},

publisher = {Emso Asset Management},

title = {Another {Way} of {Looking} at a {Country’s} {Carbon}

{Footprint:} {A} {Tale} of {Switzerland} and {South} {Africa}},

date = {2022-05-27},

url = {https://emso.com/docs/1d37859fad945759.pdf},

langid = {en}

}

For attribution, please cite this work as:

Leadbetter, Joe, Shikeb Farooqui, and Teal Emery. 2022. “Another

Way of Looking at a Country’s Carbon Footprint: A Tale of Switzerland

and South Africa.” Emso Asset Management. https://emso.com/docs/1d37859fad945759.pdf.