Welcome

I turn complex information and messy data into actionable insights. International finance, sustainability, politics, and policy.

Current Hats:

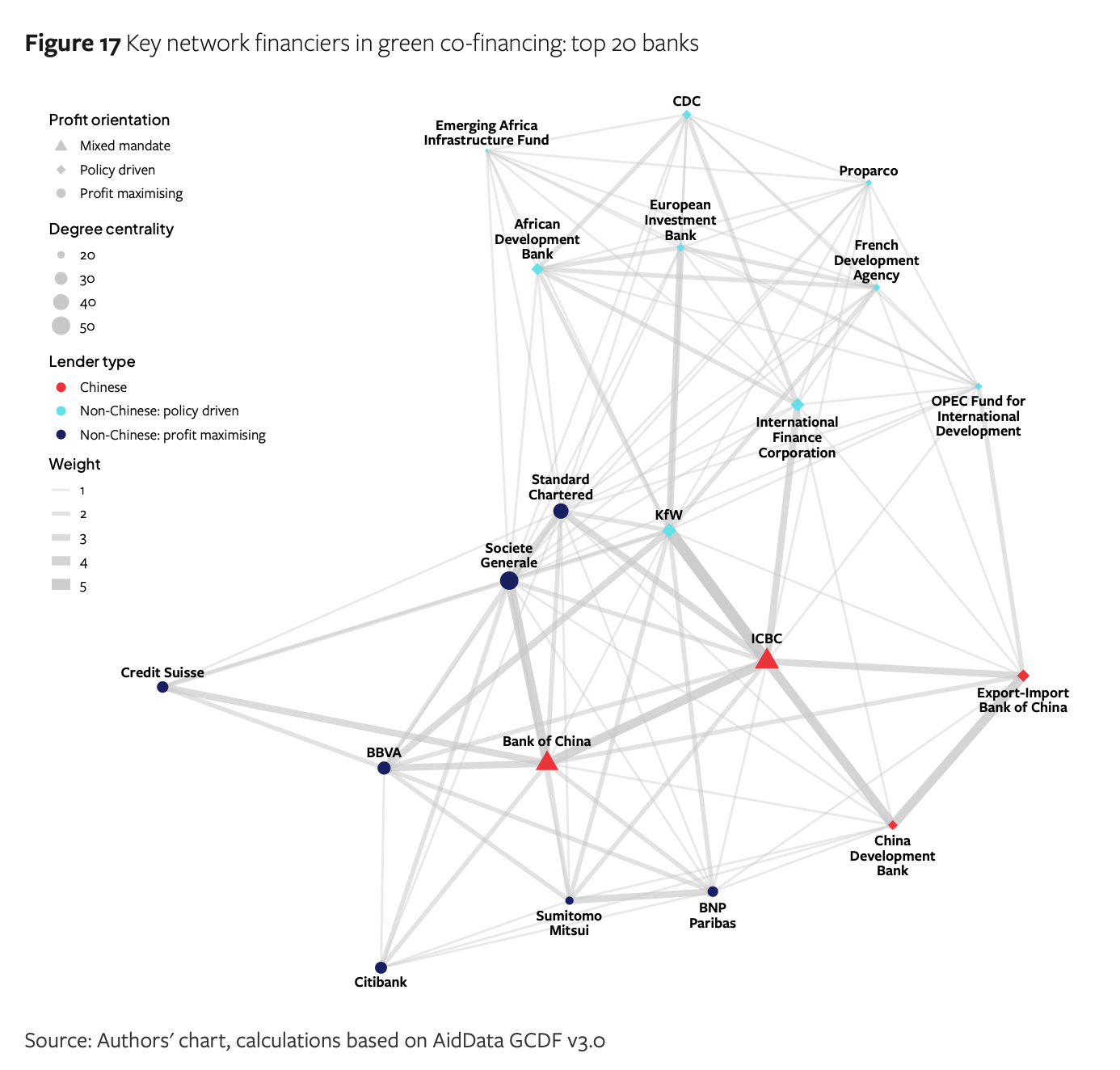

Teal Insights | Founder & Lead Researcher

AidData | Research Consultant

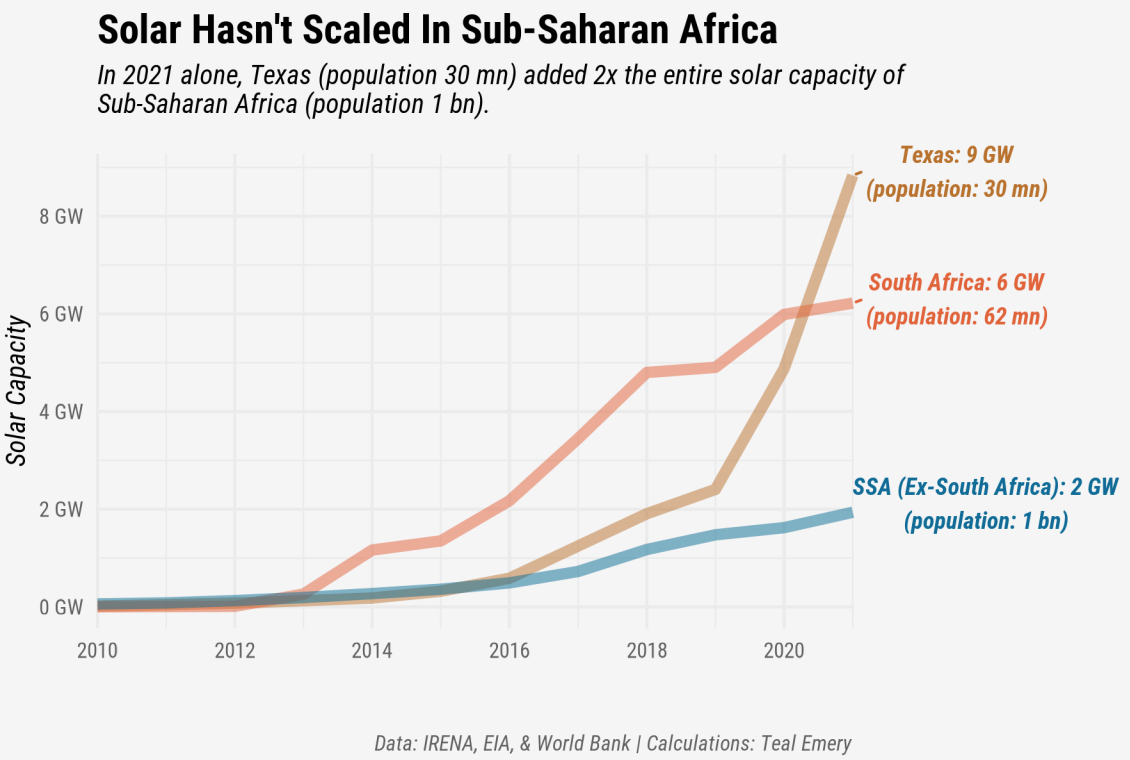

Energy for Growth Hub | Fellow

Johns Hopkins School of Advanced International Studies (SAIS) | Adjunct Lecturer in International Finance

Recent Publications

No matching items